Market Insights: all you need to know about steel trends in 2024

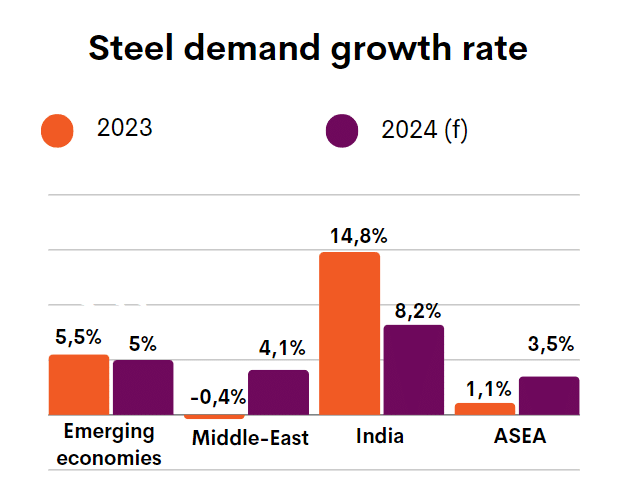

In line with what has been observed since the second half of 2023, with a slowdown in global economic activity, the start of 2024 remains in the same vein. However, a slight rebound is expected in the second half of the year, with growth in demand for steel coming in at 1.7% according to the latest forecasts from the World Steel Association. This news should be treated with caution in view of the global economic context and growing geopolitical uncertainties, but it does confirm certain trends in key regions.

Nicolas Chevanne, Commercial Excellence Manager at Winoa, takes a closer look at the key trends.

EMERGING COUNTRIES AT THE FOREFRONT

According to “New Urban Agenda” by UNO via UN-Habitat2 « By 2050, the world’s urban population is expected to nearly double, making urbanization one of the twenty-first century’s most transformative trends. Populations, economic activities, social and cultural interactions, as well as environmental and humanitarian impacts, are increasingly concentrated in cities, and this poses massive sustainability challenges in terms of housing, infrastructure, basic services, food security, health, education, decent jobs, safety and natural resources, among others.”

This is particularly true in regions such as the Middle East, India and South-East Asia, where demographic and economic development is strong. Infrastructure, housing and transport are vital to support this growth.

“The urbanisation boom in the southern hemisphere is driving global demand for steel,” says Nicolas Chevanne, Commercial Excellence Manager at Winoa.

Figures and graphics from World Steel Association

KEY USES OF STEEL

In these areas, rapid urbanisation in response to population growth is creating a strong demand for new infrastructure, and therefore for steel. The creation of decent housing, the installation of commercial premises and the development of communication routes to make towns and cities ever more accessible are all elements that require steel and therefore surface treatment by manufacturers.

“These key industrial sectors are strong indicators for all the players in our sector to follow the dynamics of the metal abrasives market, which we set at between 1 and 2% for 2024 and 2 and 3% for 2025. It’s a modest recovery, but it’s still a good signal for our customers, who have less and less long-term visibility,” explains Nicolas Chevanne.

The capital goods sector is naturally following this curve, in order to provide both professionals and private individuals with the resources associated with this growth.

Figures and charts from World Steel Association

FOCUS ON INDIA

With growth of 8.4% in the fourth quarter of 2023, the Indian economy outperformed experts’ estimates by 1.8%, according to data published by the Office for National Statistics (ONS). While India has the wind in its sails on the international stage, it is experiencing a construction boom in particular, with growth of 10.7%, stimulated by government initiatives such as the Smart Cities Mission and the development of industrial corridors. The country’s focus on improving transport infrastructure and decent housing is boosting steel consumption.

“Winoa has been present in India for 20 years and has seen the market transform in many industrial sectors. Encouraged by their government and strong population growth, it is now a strategic market for surface preparation”, explains Nicolas Chevanne.

Winoa has been present in the country for 20 years and will open its first shot peening centre there at the end of June 2024 to meet the growing demand from its local customers.

DEVELOPED ECONOMIES ON THE MOVE

While this upward trend remains true in mature markets, particularly in Europe, it is much more measured because governments are investing in the optimisation of existing assets. More sustainable cities, building renovation, new construction materials and the reduction of heavy components in manufactured products are all factors to be taken into account to explain this difference.

“Apparent steel consumption in Europe in 2024 will still be 10% lower than in 2019, so we can clearly see that the dynamics between emerging and mature markets are different in the different industrial sectors we address. These trends are sustainable, and it is up to the industrial players to anticipate, adapt and offer ever more innovative solutions to meet these new demands”.

Winoa is supporting the market transition by developing recyclable non-ferrous abrasives adapted to new light metals such as aluminium, magnesium and stainless steel. Click here to see the range of adapted products.

Figures and charts from World Steel Association